How to calculate VAT Excluding VAT from gross sum. R100 x 114 R14.

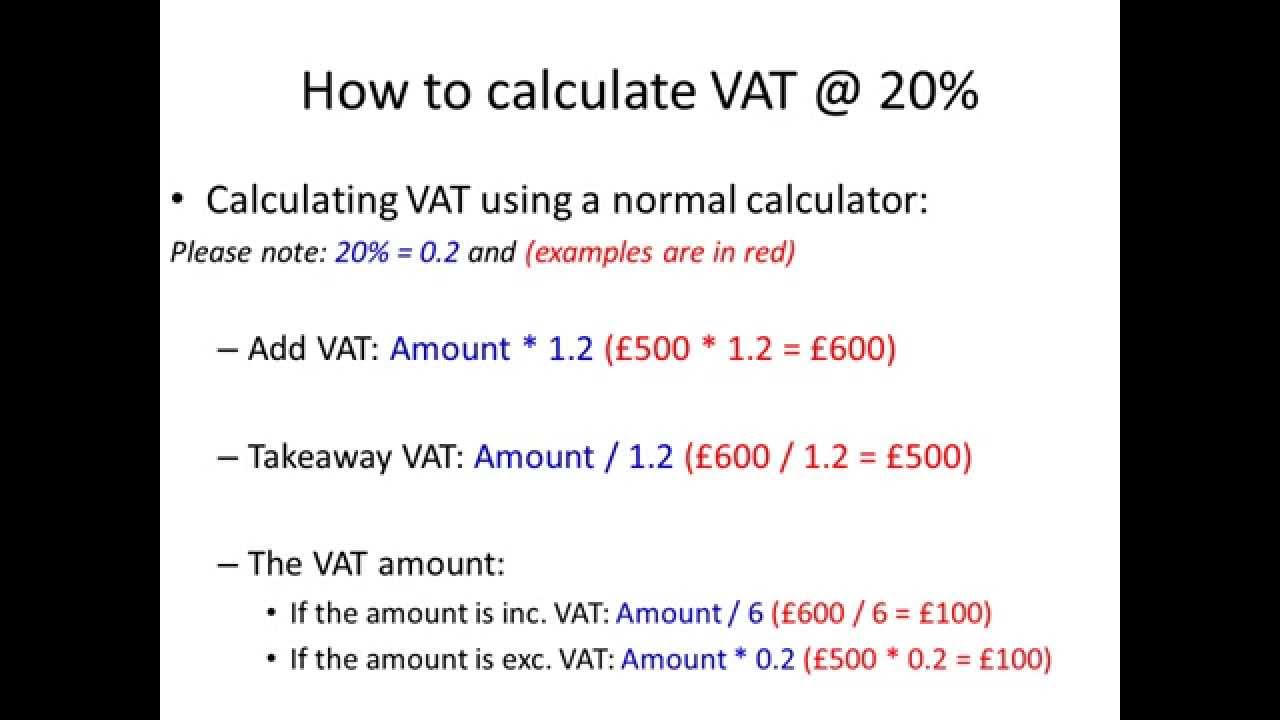

How To Calculate Vat Simple Method Vat Calculation Youtube

How To Calculate Vat Simple Method Vat Calculation Youtube

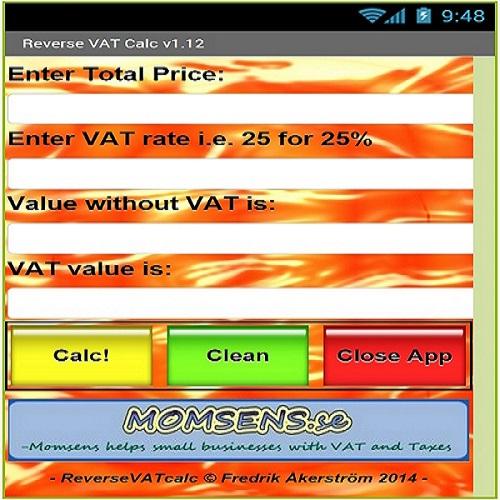

Drop-down box and use the radio buttons to decide if you want to add or subtract the VAT from the value you entered.

Quick way to calculate vat. A 4x10 2x1. Value Added Tax or VAT is paid by all residents of countries within the European Union and the United Kingdom residents will continue to pay VAT once they have left the EU. Take the gross amount of any sum items you sell or buy that is the total including any VAT and divide it by 1175 if the VAT rate is 175 per cent.

FREE Online UK VAT Calculator that is able is reverse remove include. Now GST Good and Services Tax is applied to almost every kind of goods but for some products like liquors VAT is still there. The VAT Value Added Tax is most common type of tax that is applied to goods.

This is one of the reasons why I hate QuickBooks. 20012015 Dont think so Ive not found a quick way yet. 10 is 366 and 1 is 366.

Try using VT accounts this is much easier. After reading this article you will know. We started the calculation with the net amount which doesnt include the VAT so is a VAT exclusive figure.

Calculate VAT backwards eg. For example if a purchase is 500 with 21 VAT. All you need to do is multiply your Nett amount by your ratio.

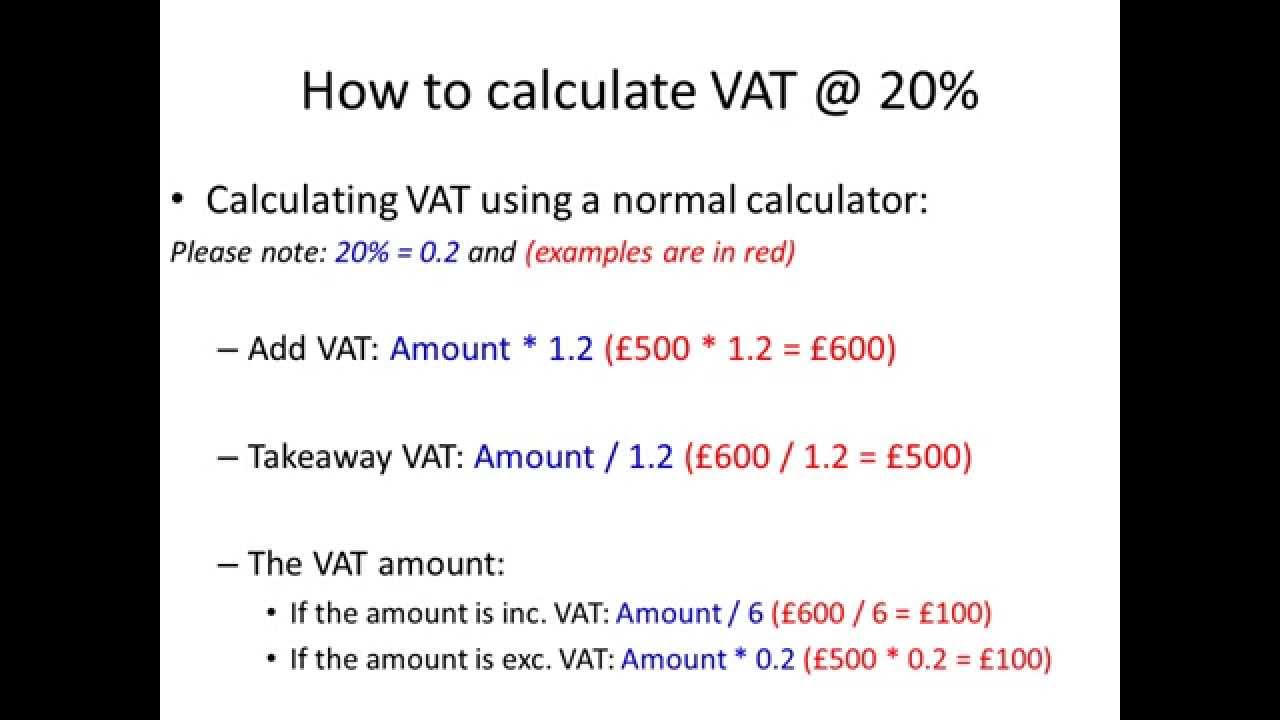

The best way to learn how to calculate VAT at 20 assuming the net value of the product is 100 is. You can calculate GST in the same way. 08112012 You add up all your sales including the output VAT youve charged and including exempt sales though not sales that are outside the scope of VAT.

20092019 The easiest method is to calculate 1 first scale that up to 20 to calculate the VAT then add the VAT to the net to calculate the gross. Ok now if you know the price of the item with VAT included in this case 120 then the reverse operation will get you back to. Both are same both give us the same answer.

Lets think about what these figures mean before we go on. Adding VAT to 100 is 120 add 20. On a more helpful note when I check a clients VAT balance I would also look at the Debtors.

Long time math fans may remember our first foray into the world of percentages way back in the 12th and 13th episodes of the podcast. Calculate the VAT inclusive portion of a price for a product or service. Calculate the VAT element and then the same with the Creditors ensuring I remove those not subject to VAT such as Rates.

Calculating the VAT Value Added Tax element of any transaction can be a confusing sum at the best of times. Therefore the VAT you would charge on your R100 product would be R14 giving you a VAT-inclusive price of R114. Step 2 - Next make sure the VAT rate with want to work with is correct in the field named Rate.

The resulting figure is. For example if you are selling a chair for 150 Nett and need to add 20 VAT to get the Gross price including VAT you use. Heres how to use this free VAT calculator website.

Calculate VAT from gross. Removing VAT is not 080 try the VAT Calculator to see Calculate the VAT content of a number which is inclusive of VAT. We can do this by taking a 4x10 2x1 or b we can also do it a different way by taking 50 and subtracting 8 ie.

17082016 In this video tutorial I will show you how to calculate VAT using a simple method and calculatorCalculating VAT can be very. If it is 15 then you should divide by 115 then subtract the gross amount multiply by -1 and round to the closest value including eurocents. To calculate VAT having the gross amount you should divide the gross amount by 1 VAT percentage ie.

31072015 If you have a product you are selling for R100 you can calculate VAT by taking the product price and multiplying it by 114. VAT calculation formula for VAT exclusion is the following. Simply enter the price into the Amount.

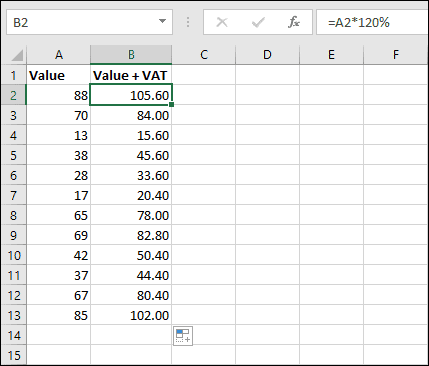

150 x 120 180. Adding VAT to an amount is very easy. In those shows we learned what percentages are how theyre related to fractions how to use percentages to easily calculate.

02122016 How to calculate percentages can be easier than you may realize. Step 1 - Enter the amount you wish to add VAT to or subtract from in the first field named Amount on the calculator. Following these simple steps can help you get it right.

Then you multiply that figure by a percentage which is called your flat rate percentage. Field above choose the applicable VAT rate from the VAT. How to use The VAT Calculator It is straightforward to use The VAT Calculator to either add VAT to or subtract VAT from a price.

120 x 100 120 Thats pretty straightforward right. Keep reading for some simple tricks. VAT Calculation in Excel.

Quick Navigation - VAT Topics. This is a free video tutorial. 14042016 To calculate VAT you will need to multiply the quantity by the tax percentage converted to a decimal for example 21 tax is 021 4 is 004 VAT price without tax 021 This will give us the amount of tax that will need to be added to the initial price to find out the final cost.

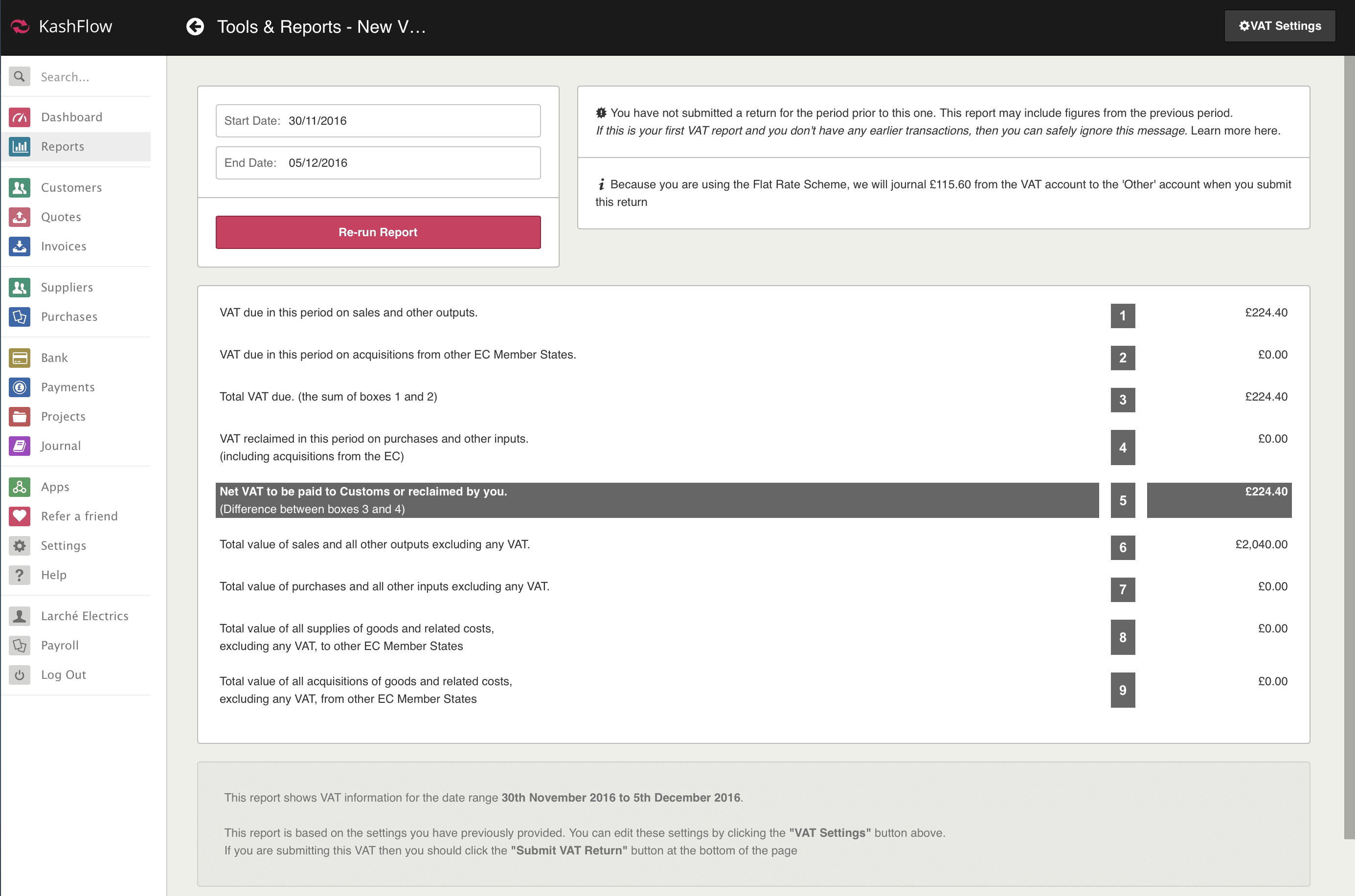

How To Do A Vat Return Kashflow

How To Do A Vat Return Kashflow

6 Quick Guide To Completing A Vat Return Infogram

6 Quick Guide To Completing A Vat Return Infogram

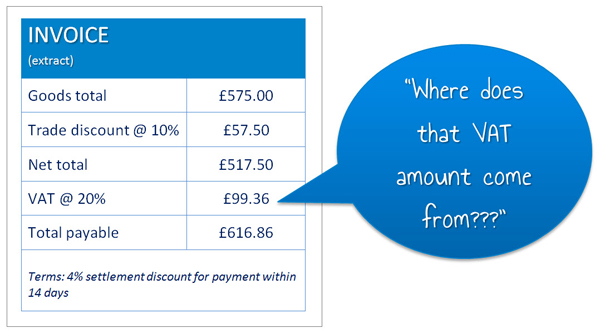

How To Calculate Settlement Discounts Accountancy Learning

How To Calculate Settlement Discounts Accountancy Learning

Uk Vat Calculator Vatcalculator Eu

Uk Vat Calculator Vatcalculator Eu

Vat Calculator Online 2021 With The Updated Vat Rates

Vat Calculator Online 2021 With The Updated Vat Rates

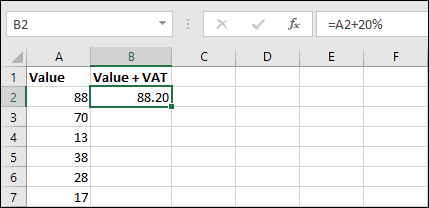

Adding Vat To A Value In Excel Thesmartmethod Com

Adding Vat To A Value In Excel Thesmartmethod Com

Backward Vat Calculator Accounting Finance Blog

Backward Vat Calculator Accounting Finance Blog

Sales With Vat Based On Quantity For Petrol And Diesel Vat Tallyhelp

Sales With Vat Based On Quantity For Petrol And Diesel Vat Tallyhelp

How To Calculate Vat In Excel Quora

How To Calculate Vat 20 Uk From The Vat Calculator Youtube

How To Calculate Vat 20 Uk From The Vat Calculator Youtube

How To Calculate Vat Excel Tutorial Youtube

How To Calculate Vat Excel Tutorial Youtube

Adding Vat To A Value In Excel Thesmartmethod Com

Adding Vat To A Value In Excel Thesmartmethod Com

How To Calculate Vat In Ksa Vat Registration In Ksa

How To Calculate Vat In Ksa Vat Registration In Ksa

What Is Vat How Much Is It And How Much To Charge Tide Business

What Is Vat How Much Is It And How Much To Charge Tide Business

Calculate Vat In Excel Excel Vat Formula Change This Limited

Calculate Vat In Excel Excel Vat Formula Change This Limited

0 comments