In this case the NPV is 40042723. Put simply NPV is used to work out how much money an investment will generate compared with the cost adjusted for the time value of money one dollar today is worth more than one dollar in the future.

How To Calculate Npv Using Xnpv Function In Excel Excel Calculator Investing

How To Calculate Npv Using Xnpv Function In Excel Excel Calculator Investing

Input your cash flows.

Quick way to calculate npv. Enter NPV select the cell with the interest rate select each cell with future profit putting a common between them. 04032018 this is definitely a case where you can apply the rule of 72 to get a rounded answer. C 2 1r 2 2000 10042 184911 NPV -1000 96154 184911 181065.

Instead of calculating the Net Present Value manually Excel NVP Function provides a quick way to calculate the Net Present Value. If you wonder how to calculate the Net Present Value NPV by yourself or using an Excel spreadsheet all you need is the formula. There are two methods to calculate the NPV in the Excel sheet.

Cash Flow for first year is 1000 and second year is 2000. Net Present Value NPV A Net Present Value is when you add and subtract all Present Values. Syntax of VBA NPV Function NPVratevalueArray.

How to Use The NPV Calculator. Excel worksheet NPV Function is similar to Excel VBA NPV Function. Let us consider that 1000 is initially invested at a rate of 4 for 2 years.

With all the information needed to calculate NPV listed on your Excel spreadsheet return to the cell you want to enter in the syntax. Find the amount of time the initial capital would double. View the calculated NPV.

In one of my last posts Agile-Giving the business options back I promised a follow-up regarding Net Present Value NPVHere you go. Where r is the discount rate and t is the number of cash flow periods C0 is the initial investment while Ct is the return during period t. NPV - 500000 181818182 24793388 15026296 NPV - 500000 695081142 NPV 8001502 Therefore NPV of the firm is 8001502.

Subtract each Present Value you pay. Dividing 72 by 4 you get 18. The following is the formula for calculating NPV.

20112019 Net present value NPV is the value of a series of cash flows over the entire life of a project discounted to the present. The best and easiest way is to use computer programs that calculate it for you since you need NPV and the formula is at least doing it my head is not in my capabilities but perhaps in yours. Net present value 1000014 500014 2 961538 462278 1423817.

21122018 NPV F 1 rn where PV Present Value F Future payment cash flow r Discount rate n the number of periods in the future Menu Corporate Finance Institute. Download the NPV calculator using the form above. Enter your require discount rate.

This will be VERY basic so if youre familiar with the concept you might be seriously bored. What will be its net present value. Our calculator can handle any number of periods you need.

Add each Present Value you receive. In simple terms NPV can be defined as the present value of future cash flows less the initial investment cost. 04022010 Net Present Value explained in simple words.

Here is how you can use this NPV calculator step by step. February 4 2010 at 1307 1 comment. Present value for year 1.

Excel VBA NPV Function. First is to use the basic formula calculate the present value of each component for each year individually and then sum all of them. Find how many times the amount would double in 54 years.

C 1 1r 1 1000 1 0041 96154 Present value for year 2. Adjust the number of periods you want in your holding period. Net present value NPV is the difference between the present value of cash inflows and outflows of an investment over a period of time.

NPV PV of future cash flows Initial Investment.

4 Ways To Calculate Npv Positive Numbers Financial Decisions Unit Of Time

4 Ways To Calculate Npv Positive Numbers Financial Decisions Unit Of Time

Calculate The Cash Flow Value By Net Present Value Calculator Npv Calculator Is The Calculator By Which You Can Cash Flow Financial Decisions Opportunity Cost

Calculate The Cash Flow Value By Net Present Value Calculator Npv Calculator Is The Calculator By Which You Can Cash Flow Financial Decisions Opportunity Cost

How To Calculate Npv Stock Market Financial Decisions How To Find Out

How To Calculate Npv Stock Market Financial Decisions How To Find Out

Npv Calculator Calculate And Learn About Discounted Cash Flows Investing Finance Investing Finance Advice

Npv Calculator Calculate And Learn About Discounted Cash Flows Investing Finance Investing Finance Advice

Http Caraharian Com Rumus Npv Html

Http Caraharian Com Rumus Npv Html

What Is The Formula For Calculating Net Present Value Npv In Excel Excel Formula Calculator

What Is The Formula For Calculating Net Present Value Npv In Excel Excel Formula Calculator

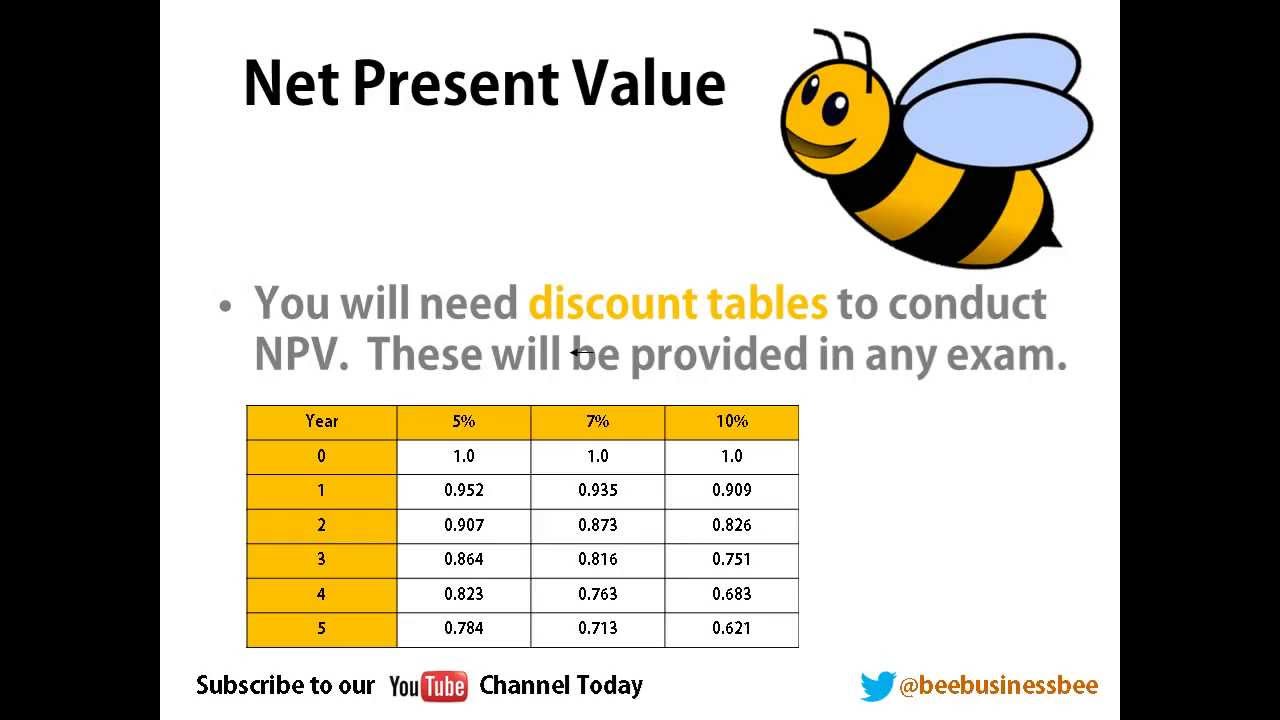

Bee Business Bee Investment Appraisal Net Present Value Npv Investing Appraisal Business

Bee Business Bee Investment Appraisal Net Present Value Npv Investing Appraisal Business

Using Excel To Calculate Npv And Irr Youtube Excel Financial Analysis Calculator

Using Excel To Calculate Npv And Irr Youtube Excel Financial Analysis Calculator

How To Calculate Npv Financial Management Investing Finance

How To Calculate Npv Financial Management Investing Finance

Net Present Value Npv Definition Examples How To Do Npv Analysis Cost Of Capital Business Valuation Company Financials

Net Present Value Npv Definition Examples How To Do Npv Analysis Cost Of Capital Business Valuation Company Financials

Pin On Business Finance Fm Video Tutorials

Pin On Business Finance Fm Video Tutorials

Npv Io Is A Web Based Net Present Value Npv Calculator Which Allows Visitors To Quickly Analyze Commer Commercial Real Estate Real Estate Investing Web Based

Npv Io Is A Web Based Net Present Value Npv Calculator Which Allows Visitors To Quickly Analyze Commer Commercial Real Estate Real Estate Investing Web Based

Definition Of Net Present Value Financial Calculators Financial Education Financial Problems

Definition Of Net Present Value Financial Calculators Financial Education Financial Problems

What Is The Formula For Calculating Net Present Value Npv In Excel Calculator Excel Investing

What Is The Formula For Calculating Net Present Value Npv In Excel Calculator Excel Investing

10 Min Npv Net Present Value Present Value Calculation Npv Explained Finance Investing Net

10 Min Npv Net Present Value Present Value Calculation Npv Explained Finance Investing Net

Cara Menghitung Npv Net Present Value Pimpinan Keuangan

Cara Menghitung Npv Net Present Value Pimpinan Keuangan

How To Calculate Npv And Irr Net Present Value And Internal Rate Return Excel Finance Spending Money Cash Flow

How To Calculate Npv And Irr Net Present Value And Internal Rate Return Excel Finance Spending Money Cash Flow

3 Easy Steps Net Present Value Explained With Npv Formula Example Cal Values Examples Formula How To Know

3 Easy Steps Net Present Value Explained With Npv Formula Example Cal Values Examples Formula How To Know

0 comments